Motorists that just have a junior certificate aren't enabled to drive within the 5 boroughs of New York City, so it's typically beneficial to bypass the junior vehicle driver's permit till he or she certifies for an elderly license. Beyond New York City City, the jr license stands with a collection of curfew and also traveler constraints specific to each region.

Coverage in Long Island City has to do with $77 more expensive than it is for the remainder of the U.S. Although these are the typical cars and truck insurance policy prices in Long Island City, you might finish up paying something various. Insurer weigh a range of aspects when figuring out just how much to charge you for auto insurance.

Average Automobile Insurance Coverage Prices by Sex $153$178 Although ladies typically pay less than males provide for vehicle insurance coverage, this is not the case in Long Island City, where women chauffeurs pay around $25 more per month. Typical Auto Insurance Prices by Driving Record $150$129Not Enough Information, Not Nearly Enough Information Your driving document can have a massive effect on your auto insurance prices. affordable auto insurance.

Vehicle and van drivers will certainly see rates of about $153 for vehicle insurance, while auto owners typically pay around $157 a month. Car age likewise plays a role in your monthly settlement. Typically, more recent cars are mosting likely to set you back the most to guarantee. insurance company. As soon as your vehicle is around 5 years old, you could start to see your rates slide back down a little.

low cost auto suvs liability cheap

low cost auto suvs liability cheap

car insurance laws vehicle car insured

car insurance laws vehicle car insured

In Long Island City, the distinction in prices based on connection status can be as much as $36 a month. laws.

If you rent your residence or home, expect to pay around $13 a month extra than if you possess your very own house in Long Island City. Those who live with their parents, nonetheless, can expect to pay a good bargain much more than their counterparts that rent out or possess. cheapest car.

Some Known Details About New York Car Insurance ~ Get A Free Quote Today - Geico

In Long Island City, the prices for vehicle insurance coverage have been blended over the past few years. They did, however, surge from $144 in 2019 to $178 in 2021. How does Long Island City compare to neighboring locations? Why are auto insurance rates in Long Island City different from other locations? Automobile insurer will certainly take into consideration a variety of factors when deciding exactly how much to charge for a policy. low cost auto.

Each area will certainly have various prices. Guides like these are a remarkable place to obtain begun. Just how can I discover the most inexpensive automobile insurance in Long Island City? Outfitting yourself with details concerning the ordinary expenses for motorists in your location will certainly much better prepare you for the actual offer. cheap car. The only method to know without a doubt what your price will certainly be is by requesting a quote from cars and truck insurer.

Place in your ZIP listed below, respond to a few inquiries, and also you'll be comparing the cheapest quotes from the many automobile insurer that offer vehicle protection in Long Island City. Long Island City Insurance coverage FAQs Automobile insurer take a large selection of elements right into factor to consider when calculating your month-to-month settlement. cheaper.

Neighborhood regulations, car park situations, and criminal activity rates-- all of which can transform from city to city-- play a huge duty in the prices that cars and truck insurance business may charge for insurance coverage. Given that the variables that go right into computing your regular monthly settlement differ from person to person, there isn't one business that will certainly always supply the least expensive rate to everyone.

You can switch business at any kind of factor, no matter of exactly how much time is left on your existing protection. credit score. Whether you're moving to Long Island City or just curious regarding rates in your location, why not take 10 mins to see if Compare. com can save you cash?.

In this article, we'll explore just how average cars and truck insurance prices by age as well as state can change. Whenever you go shopping for vehicle insurance, we advise obtaining quotes from several suppliers so you can contrast coverage as well as rates.

Some Known Factual Statements About 7 Ways To Find Good, Cheap Car Insurance - Credit Karma

Why do ordinary auto insurance coverage prices by age vary so a lot? 5 percent of the population in 2017 yet stood for 8 percent of the complete price of cars and truck accident injuries.

The price information originates from the AAA Structure for Traffic Security, as well as it accounts for any accident that was reported to the authorities. The typical costs information originates from the Zebra's State of Car Insurance coverage record. The prices are for plans with 50/100/50 liability coverage restrictions and a $500 deductible for thorough as well as crash coverage.

According to the National Highway Website Traffic Security Administration, 85-year-old guys are 40 percent more probable to obtain into a crash than 75-year-old guys (vehicle insurance). Taking a look at the table above, you can see that there is a straight relationship in between the crash price for an age which age's ordinary insurance coverage premium.

Keep in mind, you could find far better rates via another company that does not have a specific trainee or elderly price cut. car insurance. * The Hartford is just readily available to participants of the American Association of Retired Folks (AARP). Nevertheless, insurance holders can include more youthful motorists to their policy and also get discount rates. Ordinary Auto Insurance Policy Fees And Also Cheapest Service Provider In Each State Because vehicle insurance coverage rates vary a lot from one state to another, the service provider that supplies the least expensive automobile insurance policy in one state may not use the least expensive protection in your state.

You'll additionally see the ordinary cost of insurance because state to help you compare. The table also consists of rates for Washington, D.C. These rate approximates put on 35-year-old chauffeurs with great driving documents and credit history. As you can see, ordinary cars and truck insurance policy expenses differ widely by state. Idahoans pay the least for cars and truck insurance coverage, while vehicle drivers in Michigan spend the huge bucks for protection.

If you live in midtown Des Moines, your premium will possibly be greater than the state standard (insurers). On the various other hand, if you reside in upstate New York, your vehicle insurance coverage policy will likely cost less than the state standard. Within states, vehicle follow this link insurance costs can differ widely city by city.

Consumer Reports: Product Reviews And Ratings Can Be Fun For Anyone

Yet, the state isn't one of one of the most pricey total (insurance companies). Minimum Protection Demands Many states have financial responsibility laws that require vehicle drivers to lug minimal automobile insurance protection. You can just do away with protection in 2 states Virginia as well as New Hampshire yet you are still financially accountable for the damage that you cause.

No-fault states include: What Other Variables Influence Vehicle Insurance Coverage Fees? Your age as well as your home state aren't the only points that influence your prices.

Others provide usage-based insurance that may conserve you money. If your auto is one that has a likelihood of being swiped, you might have to pay more for insurance policy.

In others, having bad debt might cause the price of your insurance premiums to increase drastically. Not every state allows insurance companies to use the gender detailed on your chauffeur's license as a figuring out element in your costs. But in ones that do, women motorists typically pay a little much less for insurance policy than male motorists.

affordable car insurance cheaper cars car cheap auto insurance

affordable car insurance cheaper cars car cheap auto insurance

Policies that just meet state minimal coverage demands will be the most inexpensive. Added insurance coverage will set you back even more. Why Do Vehicle Insurance Prices Adjustment? Taking a look at average automobile insurance rates by age as well as state makes you ask yourself, what else affects prices? The solution is that car insurance coverage prices can change for lots of factors.

An at-fault accident can increase your price as a lot as half over the next three years. If you were convicted of a DUI or carried out a hit-and-run, your rates will increase a lot more. However, you don't need to be in an accident to experience rising prices. Overall, automobile insurance tends to obtain more costly as time goes on.

Not known Incorrect Statements About The Cheapest Car Insurance Companies (May 2022)

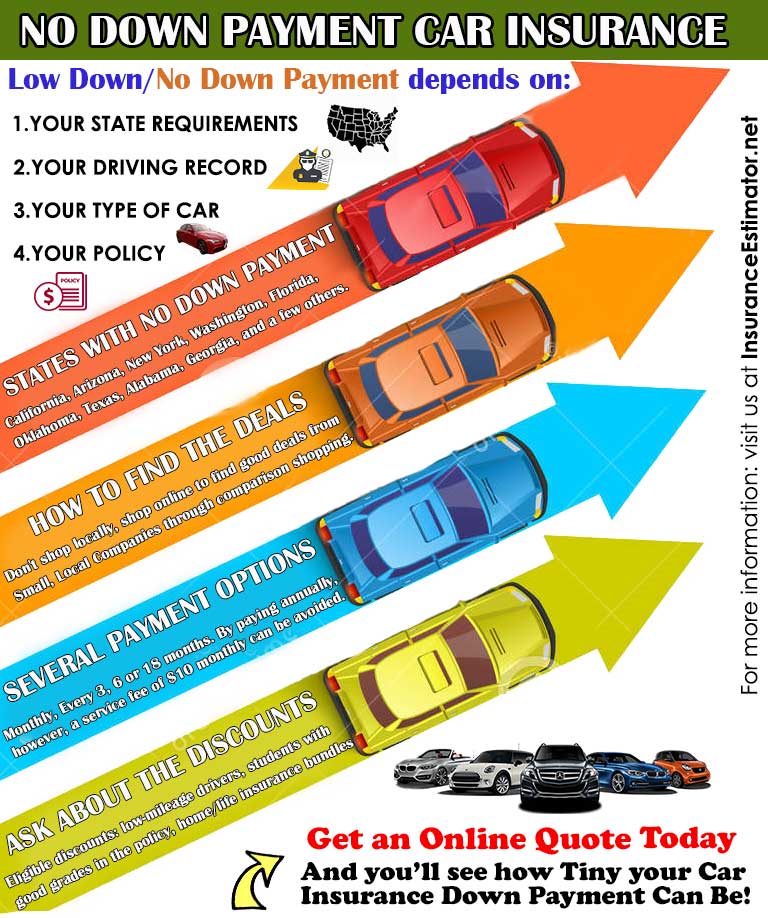

There are a number of various other price cuts that you could be able to exploit on right currently. Below are a few of them: Many companies give you the most significant discount for having an excellent driving history. Called bundling, you can obtain lower prices for holding more than one insurance policy with the same company.

Property owner: If you possess a residence, you might get a homeowner discount from a number of suppliers. Get a discount for sticking to the exact same firm for several years. Right here's a key: You can always compare prices each term to see if you're getting the most effective rate, despite your commitment discount rate.

Some can additionally raise your rates if it transforms out you're not a good chauffeur. Some business provide you a discount rate for having a good credit rating. When looking for a quote, it's an excellent concept to call the insurer and also ask if there are any even more price cuts that relate to you.

The average price of a complete coverage insurance coverage plan in New York City is $4,822 per year. Prices are higher in New York City just since of how lots of people live there, and also the already-high price of living.

Our professionals right here at Policygenius can aid direct you to the coverage that functions best for you. Trick Takeaways Main Road America has the most affordable ordinary prices in New York City at $1,599 per year for complete insurance coverage (insurance).

Cars and truck insurance coverage prices are different for every person. Personal information like the car you drive, the amount of protection needed, and also also whether you're single or wedded effects your rates - perks. To conserve cash on automobile insurance, it's always a great suggestion to compare quotes as well as select the protection that functions ideal for your insurance policy needs.

The Only Guide for New York Car Insurance Guide (Cheap Rates + Best ...

If you reside in a community that has a higher criminal activity rate, opportunities are you're paying much more for cars and truck insurance policy. ZIP codes are among the largest aspects utilized to identify auto insurance coverage rates. auto. The more criminal offense as well as mishaps in a provided area, the more every person pays. Below are the typical rates in ZIP codes across New York City.

You want a firm with experience as well as client service that listens to your needs. When it's time to sue, you expect your insurance provider to make the procedure as seamless as possible - cheaper auto insurance. At Policygenius, we can assist you see quotes from leading business, so you can pick one that satisfies all your demands.

In New York City, a solitary ticket for racing might increase your rates by $1,800 over 3 years, as well as various other offenses, like a DUI or a hit-and-run, can boost your prices also a lot more. Below are the average cars and truck insurance coverage prices for vehicle drivers in New york city City with speeding tickets or various other moving violations on their driving document. insurance company.